You're doing this as a business, not as an employee. This is because you are an independent contractor. Paycheck? We don' get no stinkin' paycheck! They don't take money out for your state or Federal income tax. They aren't sending in your Social Security and Medicare. And no taxes are taken out of what you receive. For most of us it's direct deposited the same as a paycheck. No taxes are taken out of your Doordash paycheck. Now that that's all out of the way, let's get started. The basics are pretty much the same for Uber and Lyft and other forms of self-employment. This stuff applies just as much for Instacart, Uber Eats, Grubhub, Postmates. That's simply because Doordash has become so dominant in gig economy delivery. I mention Doordash a lot when talking about taxes here. But if you understand how it works, you are able to do more yourself. They know the more complicated parts of it all. Is this a contradiction? I say it's not as mysterious. If you need specific advice for your taxes, seek out your own advice from a tax professional. The purpose here is to explain how it works, not to give you tax advice. Your best bet is to find a CPA or Accountant (not just a tax preparer) who undestands gig economy taxes That's the only piece of advice I'm offering here. Get a tax professional, not a tax preparer. Get a CPA or accountant, someone who does this for a living. Find someone who understands self employment. I really, really, really recommend you get someone to help you with your taxes. The best ways to use this knowledge and prepare for taxes.Understanding how the tax return process works and how your Doordash income fits into it.Understanding the different taxes you pay.You're taxed based on profit, not on the money you get from Doordash.You will file your own taxes on Doordash (and other independent contractor work) income as a business owner.No taxes are taken out of your Doordash paycheck.Here's what we'll talk about in this overview. You'll find links to articles with more detail on a topic as we go along. All of this so you can get the overview, then drill down into the details. I have a tax guide that covers a lot of the same questions but in a more explanatory manner. I've put together several FAQ pages on how your taxes work. So from here, I want to give you more details. Once you understand how it works, the details become less intimidating. But once you understand how it works, it's hard to find the details. That's because it's important to start with a basic understanding. Everything I find is just an overview with just general information. I see a lot of articles out there that try to explain taxes. Here's why I'm writing this the way I am.

How Uncle Sam decides how much to collect, and how it's collected, that's where there's a bit more detail. When ever you make money, Uncle Sam wants a piece of it. Let's break down how Doordash and independent contractors work. Once you know how it works, you can be prepared. Those taxes you pay for Doordash aren't so intimidating any more. The basics are much simpler to understand than you might think.Īnd once you understand them, knowledge is power. We dread tax season because it's such a mystery.īut that's the thing: Doordash taxes aren't that much of a mystery. What if I told you it doesn't have to be that bad? Let's just say there are a lot of mixed up ideas. To make it worse, have you seen all the bad advice floating around out there? Go check it out on Dasher Facebook and Reddit groups. Everyone's telling you not to bother asking questions or trying to find out. Why are taxes such a mystery? I mean, they must be.

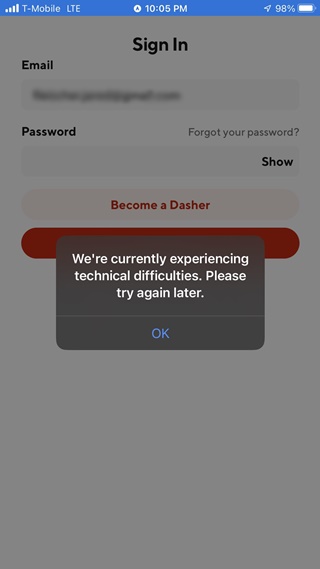

#Doordash driver login full#

Maybe it's more like ‘time to use strong language.' Whether you do gig work full time or it's a side job, taxes can be frustrating. You might be past the ‘time to sigh' stage.

0 kommentar(er)

0 kommentar(er)